Business Insurance in and around Omaha

Looking for small business insurance coverage?

This small business insurance is not risky

Help Protect Your Business With State Farm.

Do you own a cosmetic store, a window treatment store or a home improvement store? You're in the right place! Finding the right insurance for you shouldn't be risky business so you can focus on your next steps.

Looking for small business insurance coverage?

This small business insurance is not risky

Keep Your Business Secure

The passion you have to be a leader in your field is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Jensen Collie. With an agent like Jensen Collie, your coverage can include great options, such as business owners policies, commercial auto and artisan and service contractors.

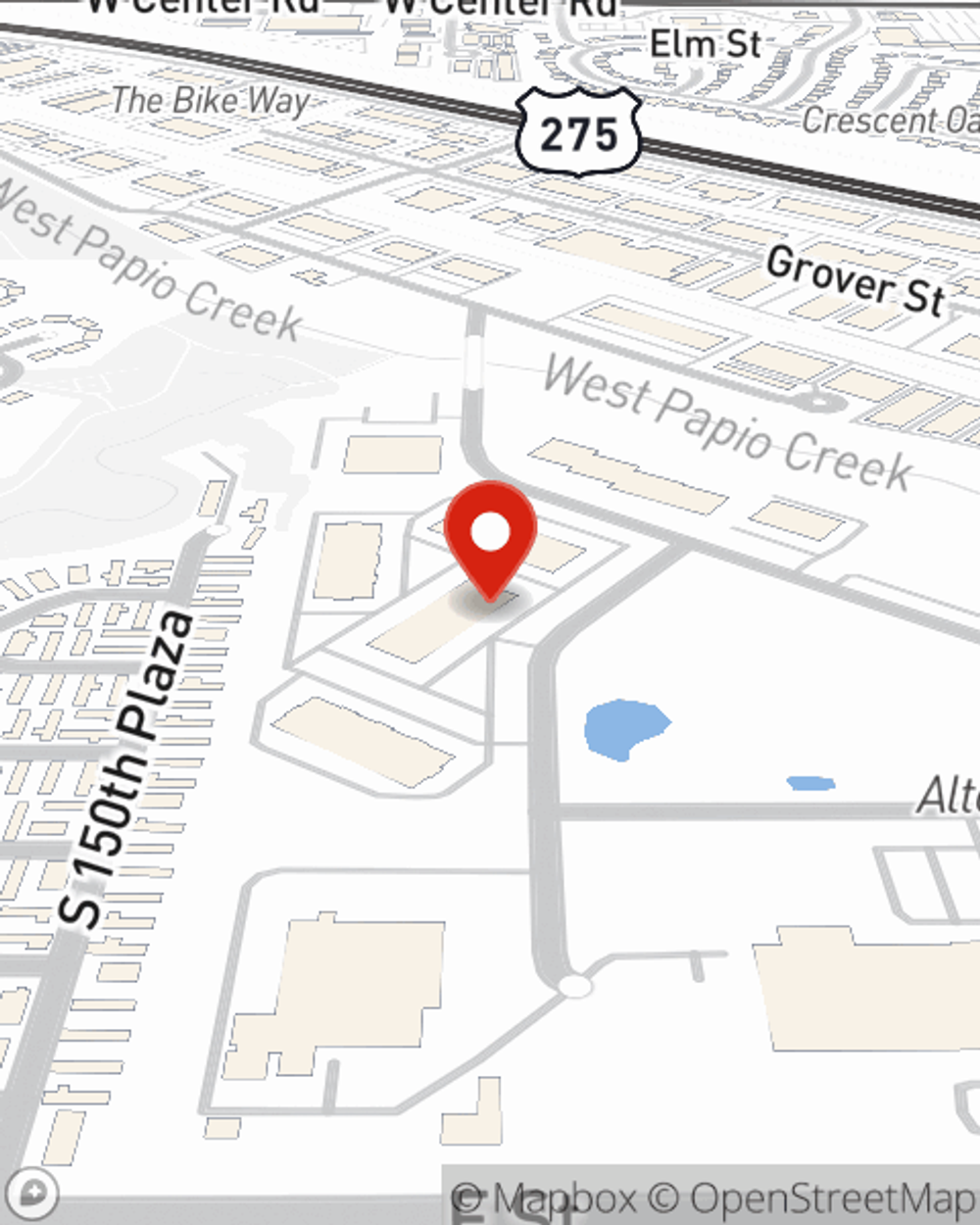

The right coverages can help keep your business safe. Consider visiting State Farm agent Jensen Collie's office today to explore your options and get started!

Simple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Jensen Collie

State Farm® Insurance AgentSimple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.